Building wealth has been a learning process for me. I tried being an independent consultant before it was popular. I designed systems for cardiac surgeons and cardiologists as well as trained doctors in using computers (in 1995). However, marketing was not one of my strongest areas. So, I became an employee.

In 2009, I returned to consulting and explored various paths—product development, entrepreneurship, coaching, and community building. What worked best was focusing on one stable revenue source like consulting. I honed my skills to command premium fees.

I invested my earnings in two main ways: real estate and stocks. Stocks were a better fit for me because I could start small and adjust my investments as needed. Over time, my portfolio grew by 182%. Even though I still own some properties, I didn’t get the same returns as stocks.

Investing in stocks also taught me valuable lessons about management and running a business. This knowledge has come full circle, helping me improve my revenue generation capabilities even more.

Finally, I learned about tax planning – not avoiding them, but planning for them. When I started, I knew nothing about tax-saving options. A CA enlightened me on how to plan my taxes efficiently, whether through an LIC policy, home loan repayment, or other means.

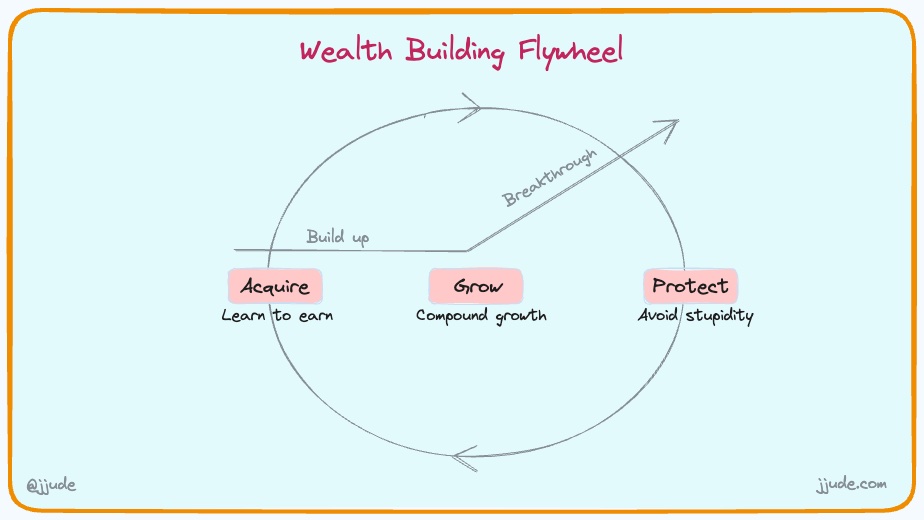

By combining these aspects – generating revenue, investing in compounding assets, and planning taxes effectively – I’ve built wealth and grow my career without any leaks.

Comments

When you write, you share with the intention of giving it all. Generously. I recently realised that it is also a form of spirituality. Hats off to you Dear Joseph. Kindly share more details pertaining to the lessons learnt while investing in stocks.

Much thanks and sincere regards.